ESG Agenda in Brazil: The Convergence of Sustainability, Technology, and Regulation

The Brazilian corporate landscape is constantly evolving, particularly concerning the growing importance of environmental, social, and governance (ESG) considerations. The intersection between the need to adopt sustainable practices and the technology to facilitate this adoption is redefining business. In this context, the role of SAP solutions, with the support of experts like TrustSis Consultoria, is invaluable.

The term ESG was coined in 2004 in a publication by the Global Compact in partnership with the World Bank, called Who Cares Wins. It emerged from a challenge by UN Secretary-General Kofi Annan to 50 CEOs of major financial institutions on how to integrate social, environmental, and governance factors into capital markets

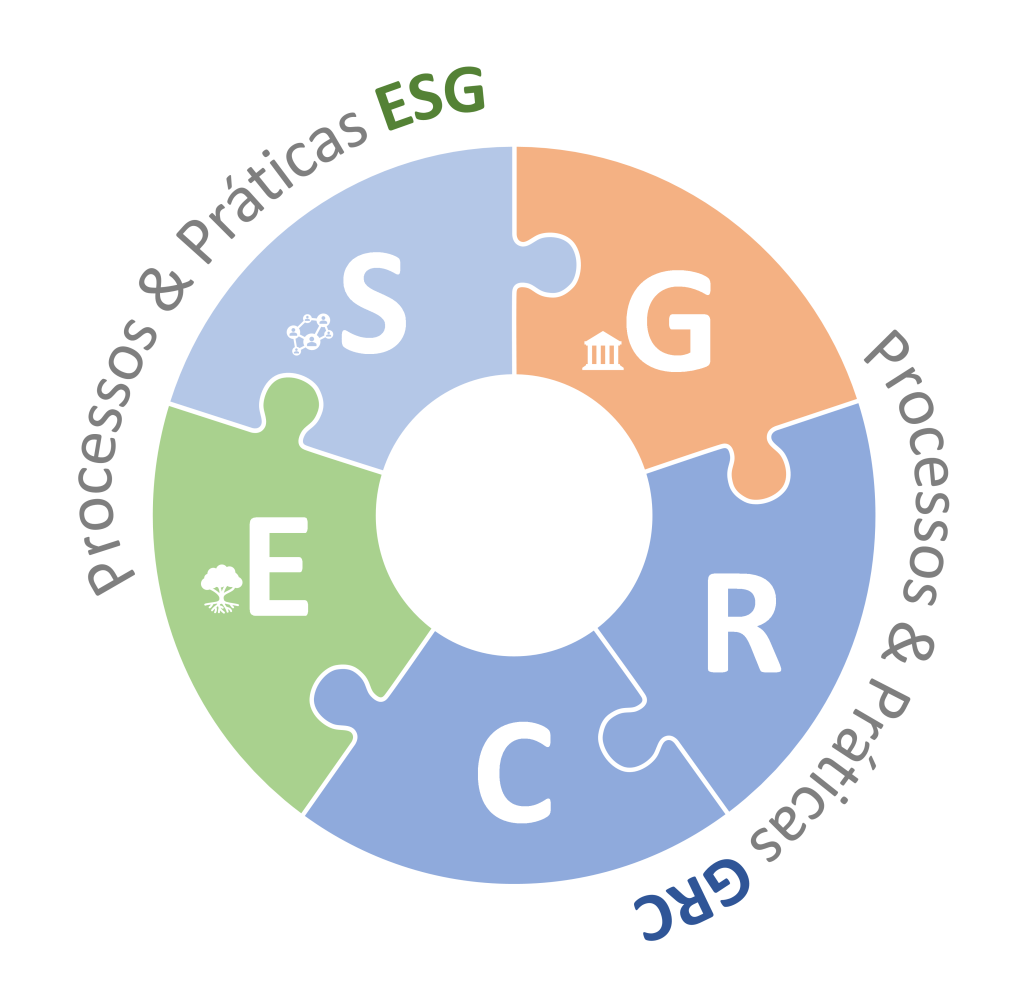

Environmental (E – Environmental):The environmental pillar of ESG focuses on how companies impact the environment. This includes issues such as reducing carbon emissions, efficient resource management, waste management, biodiversity conservation, and climate impact. Companies committed to environmental ESG generally seek sustainable practices, green innovation, and transparency regarding their environmental goals and results.

Social (S – Social): The social pillar encompasses companies’ interactions with society at large, their employees, customers, and communities. This involves aspects such as workplace diversity and inclusion, workers’ rights, occupational health and safety, community relations, philanthropy, and social engagement. Companies that take social ESG seriously are committed to creating fair, safe, and inclusive work environments and also contributing positively to society as a whole.

Governance (G – Governance): .The governance pillar refers to a company’s leadership structure and decision-making processes. It includes issues such as the composition and independence of the board of directors, corporate ethics, financial transparency, regulatory compliance, and risk management. Companies with good governance are generally more stable, responsible, and capable of creating sustainable long-term value for all stakeholders.

ESG in Brazil: More Than a Trend, a Necessity

The understanding and applicability of ESG criteria by Brazilian companies are increasingly becoming a reality. Acting in accordance with ESG standards enhances the competitiveness of the business sector, both domestically and internationally. In today’s world, where companies are closely monitored by their various stakeholders, ESG signifies solidity, lower costs, better reputation, and greater resilience amid uncertainties and vulnerabilities.

The recently released Panorama 2024 Survey by AMCHAM underscores the importance of ESG and technology, especially artificial intelligence, in shaping the future of Brazilian businesses. With ESG currently regarded as the second most important topic for companies, the Brazilian market is redefining its paradigms, seeking a balance between economic development and socio-environmental responsibility.

The Role of Regulation: Preparing for a Sustainable Future

Brazilian legislation, through laws such as the Forest Code and the National Policy on Climate Change, has indicated the direction to follow. On the global stage, agreements like the Paris Agreement reflect larger commitments. Companies that anticipate and adapt to these regulations not only ensure compliance but also stand out as leaders in sustainability.

National Solid Waste Policy (Law No. 12,305/2010): Establishes principles and guidelines for solid waste management, promoting companies’ environmental responsibility.

National Climate Change Policy (Law No. 12,187/2009): Establishes guidelines for the development of public policies aimed at mitigating and adapting to climate change, impacting companies in terms of emission reports and sustainability.

Anti-Corruption Law (Law No. 12,846/2013): Holds companies accountable for acts of corruption, encouraging the adoption of ethical and transparent governance practices.

General Data Protection Law (LGPD) (Law No. 13,709/2018): Establishes criteria applicable to the security and protection of data related to customers and third parties in companies’ activities.

CVM Resolution 59/21: Institutionalizes regulatory norms and procedures for publicly traded companies regarding the adoption of ESG practices (for publicly traded companies to communicate their information to the market considering the integration of ESG aspects).

Paris Agreement: Brazil is a signatory to this international agreement, committing to reducing carbon emissions, which pressures companies to consider emission reduction strategies in their operations.

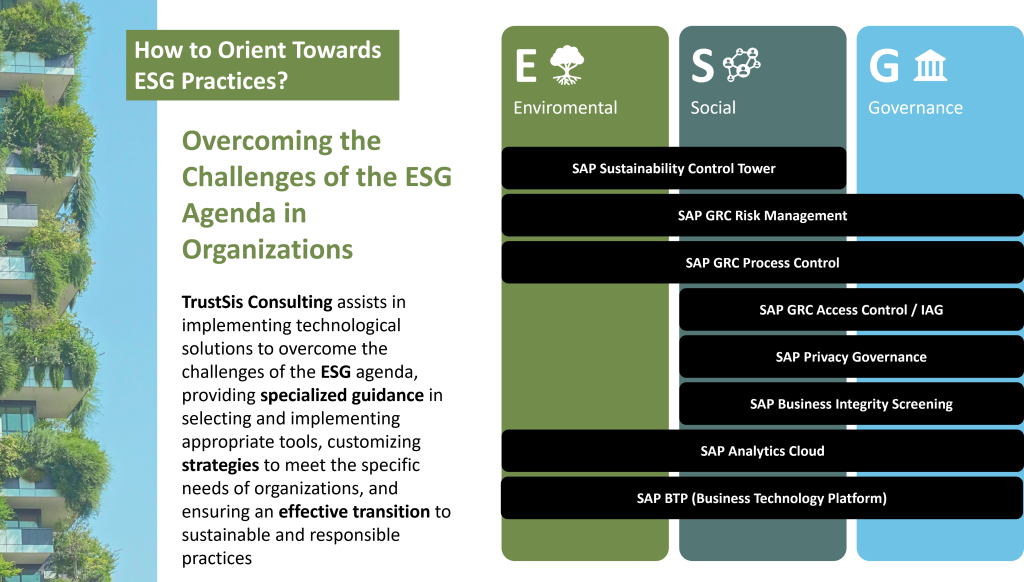

SAP Solutions: Digital Catalysts for ESG Transformation

The journey to full ESG integration is complex and multifaceted. Here, SAP solutions present themselves as indispensable tools:

Figure 1: Overcoming the CHallenges of the ESG Agenda in Organizations

|

|

The ESG agenda in Brazil is a promising combination of responsibility, innovation, and opportunity. With the right technology, regulatory guidance, and the expertise of partners like TrustSis Consultoria, Brazilian companies are well-positioned to lead a sustainable revolution.

References:

Pacto Global – https://www.pactoglobal.org.br/pg/esg

PESQUISA PANORAMA 2024 | AMCHAM – https://conteudo.amcham.com.br/panorama-2024#rd-section-ljg10d3g

sales@trustsis.com | Trustsis.com